In Rhode Island, consumers facing aggressive or unfair debt collection practices are protected by state and federal laws, including the Debt Collection Practices Act (DCPA). A debt collector lawyer specializes in these regulations, offering guidance, negotiation, and legal action against abusive collectors. Firms like Spam Call law firm RI assist debtors in navigating debt collector laws Rhode Island, do-not-call lists, and their consumer rights. Engaging a qualified attorney is crucial for fair treatment during stressful situations.

Rhode Island has stringent laws in place to protect residents from aggressive debt collection practices. Understanding your rights under these regulations is essential when facing debt harassment. This article guides you through the intricacies of Rhode Island’s debt collector laws, empowering you to know what to expect from collectors and how to take action if your rights are violated. If you need legal aid, discover top-rated debt collector lawyers in Rhode Island who specialize in defending debtors under state law, including the ‘Do Not Call’ regulations and spam call restrictions.

Understanding Rhode Island's Debt Harassment Protection Laws

In Rhode Island, consumers are protected against unfair and aggressive debt collection practices through a series of comprehensive laws. These regulations aim to safeguard individuals from harassment, false representations, and abusive tactics employed by debt collectors. Under the Debt Collection Practices Act, debt collectors in RI must adhere to specific guidelines, including restrictions on calling times, disclosure of information, and the language used during communications. Any violation of these rules can result in legal action against the collector.

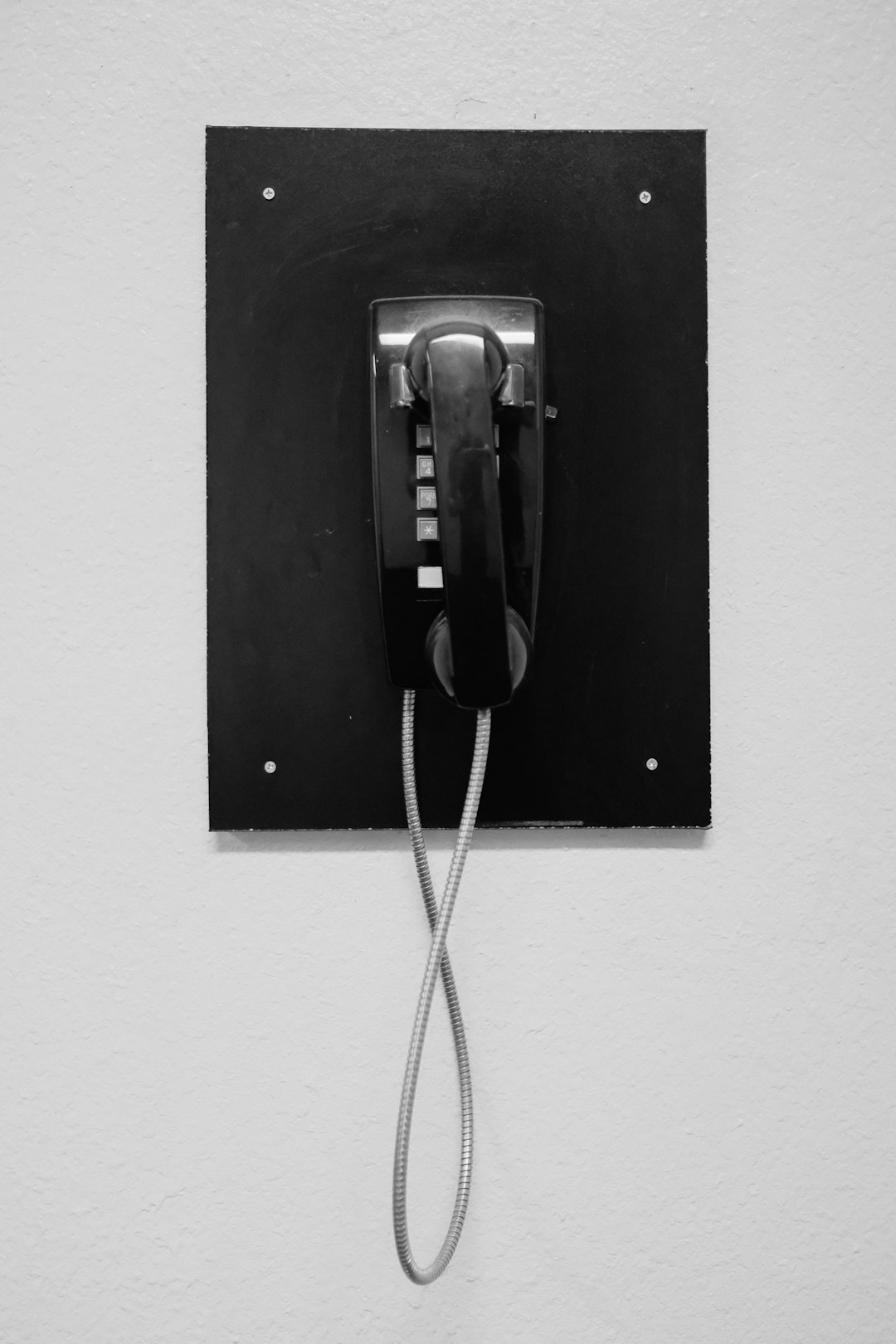

When it comes to dealing with persistent or harassing debt collectors, a debt collector lawyer in Rhode Island can provide essential guidance and representation. These attorneys specialize in navigating complex debt collection laws and protecting clients’ rights. They can assist in blocking unwanted calls, negotiating with collectors, and even suing for damages if necessary. With the help of a skilled debt collector attorney RI, residents can effectively exercise their legal protections and ensure they are treated fairly during the debt collection process.

Your Rights as a Debtor in RI: What to Expect from Debt Collectors

In Rhode Island, debtors have several rights and protections when dealing with debt collectors. According to the Debt Collection Practices Act (DCPA), a federal law designed to curb aggressive collection tactics, debt collectors must refrain from making false or misleading statements, using abusive language, or employing unfair methods in their attempts to collect debts. They are also required to provide borrowers with specific information, including the amount owed, the name of the original creditor, and validation of the debt.

When a debtor in Rhode Island feels harassed or mistreated by a debt collector, they have legal recourse. A debt collector lawyer in RI can help navigate these complex laws and protect one’s rights. The Spam Call law firm RI can file complaints with regulatory bodies, negotiate with collectors, or even take legal action if necessary to ensure that debtors are treated fairly under the debt collector laws Rhode Island. This includes the state’s Do Not call law firms Rhode Island, which offer additional safeguards for consumers facing relentless collection calls.

Taking Action: Finding the Right Debt Collector Lawyer in Rhode Island

In Rhode Island, individuals facing debt harassment have legal protections in place to ensure fair and ethical collection practices. One crucial step is to identify and engage a qualified debt collector lawyer who specializes in defending clients’ rights under the state’s debt collector laws. These legal professionals can provide guidance tailored to Rhode Island’s regulations, such as those regarding spam calls and do-not-call lists. They help consumers understand their rights and take appropriate action against abusive collection tactics.

When searching for a debt collector attorney in RI, it’s essential to look for someone with expertise in navigating the complex legal landscape surrounding debt collection. With the right lawyer by your side, you can assert your rights, challenge unfair practices, and hold debt collectors accountable under state laws. This proactive approach ensures that you receive fair treatment during what can be a stressful situation.